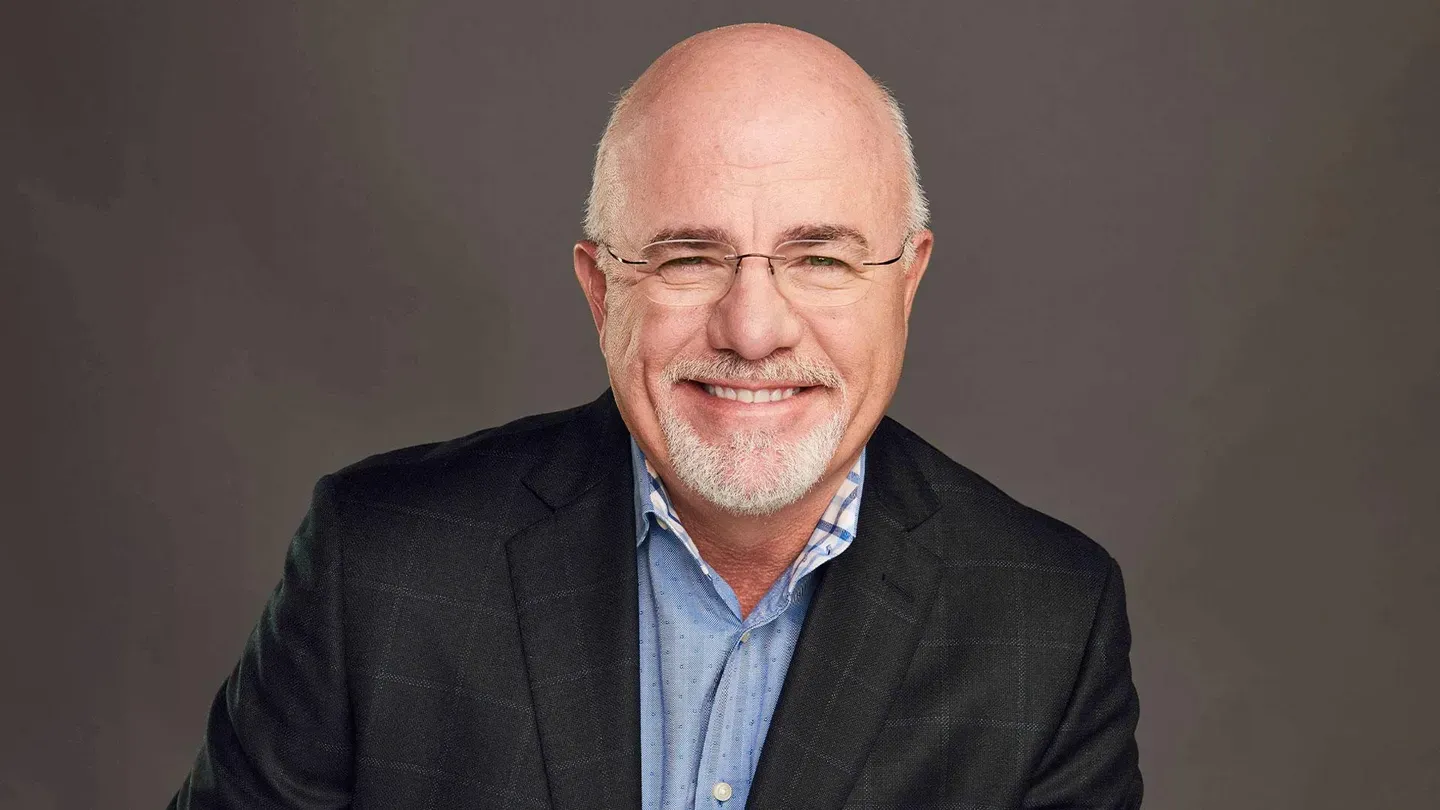

Dave Ramsey - Money Mindset

5/4/2021 | 26m 46sVideo has Closed Captions

How to make and manage your money in times of uncertainty.

Financial teacher and Best-Selling Author Dave Ramsey shares how to make and manage your money in times of uncertainty.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

The School of Greatness with Lewis Howes is presented by your local public television station.

Distributed nationally by American Public Television

Dave Ramsey - Money Mindset

5/4/2021 | 26m 46sVideo has Closed Captions

Financial teacher and Best-Selling Author Dave Ramsey shares how to make and manage your money in times of uncertainty.

Problems playing video? | Closed Captioning Feedback

How to Watch The School of Greatness with Lewis Howes

The School of Greatness with Lewis Howes is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship>> Hi, I'm Lewis Howes, New York Times best-selling author and entrepreneur, and welcome to "The School of Greatness," where we interview the most influential minds and leaders in the world to inspire you to live your best life today.

In this episode, we sit down with Dave Ramsey, number-one New York Times best-selling author and more than 11 million copies of his books sold.

A personal money management expert and one of the top radio show personalities on the topic of money.

And today, we talk about how to master your money in a time of uncertainty.

I'm so glad you're here today.

So, let's dive in and let the class begin.

♪ ♪ Why is a time like this a great time to make money?

>> It's a great time to be introspective and to pivot and to do resets and to try stuff you never tried before.

>> Yeah.

>> You may have a situation where you hated your job.

I mean, statistics tell us that 68% of Americans hate their job.

And some of you don't have that job anymore, so you get the opportunity to get one you like now!

And you might not have done that on your own, so this could be the best thing that ever happened to you.

There's a lot of good that comes out of this much pressure because it forces you to reset.

>> Yeah.

>> It forces you to rethink.

And, you know, two or three, four crisises ago -- I don't know, back -- I'm an old guy now.

I had a personal crisis, you know, of losing everything.

I decided I was never gonna be the victim of the things I can control when one of these things that I can't control come at me again.

And so, we got out of debt, and we built an emergency fund, and in the last downturn of 2008, we were in a position -- We had piles of cash.

And so, I was able to buy real estate at a nickel and a dime on the dollar.

It was a wonderful time.

But there were other times I was broke and couldn't take advantage of stuff being on sale.

>> You mentioned you've been through three or four recessions.

I don't want to say your age out here, but it sounds like you've been -- >> I'm 60.

>> You've been around the block.

You've experienced some stuff.

You know, I only went through, really -- When I was 24, I guess it was -- the 2008, 2009 timeframe when I just got out of school, and I was trying to figure out my life.

I had three credit cards I was living off of.

I was living on my sister's couch for a year and a half.

I was in college debt, and I didn't have any "skills" that I thought were usable to get a job or do anything.

And when I look back, you know, 11, 12 years ago, that was actually the greatest time and the greatest gift for me to develop skills, to work hard, to hustle, to try to see, "How can I make $100 here and there and then turn that into a business?"

And it was the greatest -- It was the hardest time and the greatest time for me.

I'm curious, with your experience in watching these over the years, what were the greatest lessons you learned from each one?

>> Well, it is cliché, but clichés come from truth.

>> [ Laughs ] >> That, you know -- You know, it's the greatest time and the worst time in your life.

You don't want to go back there.

>> No.

>> Good Lord, no.

I don't want to go back there.

I went bankrupt.

I lost everything in my 20s.

I don't want to go back there.

But the lessons that I learned from that pain were so thorough.

>> Mm.

>> Pain is a thorough teacher.

>> Yes.

>> You know, it was a rich time.

The fertilizer was everywhere.

You know, that's what you had there in 2008.

>> Yeah.

>> There weren't any jobs.

You couldn't, like -- I mean, there was a contraction of the economy -- a recession -- and there you are on your sister's couch.

And so, you found out that the secret sauce in your life is the guy in your mirror.

>> Mm-hmm.

>> That it's not some outside variable that's gonna come and save you.

The cavalry's not coming.

Santa Claus doesn't live in Washington, D.C.

It's up to you, baby.

>> Mm-hmm.

>> Get up off the couch.

I got to go leave the cave, kill something, and drag it home.

You found that truth in that moment.

I found that truth that, you know, what doesn't kill you makes you stronger.

You know, that old saying.

I found that truth.

The truth is, there's a lot of reason to have hope.

>> Yeah.

And so, your personal -- I guess I'm just curious about your personal thoughts.

Do you think to yourself, like, "I'm fine, 'cause I've followed my seven steps for years, and I've got cash, and I feel safe and protected.

So, now, how can I shift and adapt and pivot and serve my community and customers more?"

Or do you feel any anxiety personally at all, or...?

>> Oh, no, none.

No, I mean, we're in fabulous financial shape.

>> Yeah.

>> It's not arrogance.

It's just, I've been doing this a long time.

>> You're the king of it.

Yeah.

>> I'm the little pig in the brick house.

You know, I mean, huff and puff, baby.

But it does put you in a position to serve, then, and truthfully, you get more joy, even in a crisis, in serving than you do in sitting in the basement and counting your coins.

So, the opportunity -- I got a thousand folks on our team, and, you know, the struggle and the scratching and the scrappiness and the clawing to keep this place running and all of them not have their incomes interrupted in any way during this time, that's an act of service and leadership.

The act of service of speaking hope and life into the communities around America right now is an act of service on my part.

It's being on the air three hours a day on "The Dave Ramsey Show" and saying, "It's gonna be okay.

It's gonna be okay.

It's gonna be okay."

Over and over and over again.

Right now, that's my job.

That's what I do.

And that's just so much more satisfying than counting coins.

>> I followed your steps when I was, you know, 25, 26, when I started making some money -- when I was like, "It's hard to follow the step when you feel like you're living off credit cards and in debt and you're not making any money."

You feel, like, this sense of helplessness, really.

And I know I've listened to a lot of your shows with people where they feel helpless, and it takes that initial momentum to kind of kick-start it and see a little savings here and there, and then pay off one thing here and there.

But I tell you, once I finished those five to six steps, and then building wealth and giving, I feel so much more bulletproof now after 10 years of building into this recession.

I feel safe.

I feel fine.

I feel protected.

And it gives me so much more peace of mind since I did follow your steps.

So I first want to acknowledge you for that -- for creating something so simple for us and providing this three hours a day for everybody.

I think it's amazing.

You sound like a preacher and a motivational speaker to me in the last few minutes.

>> [ Laughs ] >> Just speaking life and hope into us, so I appreciate that.

What are you telling to people right now who are saying, "You know what?

I didn't follow your advice.

I didn't do what I should have done.

I still live off of credit cards.

I overbought, paid for my house, and I've got this expensive lifestyle and credit cards that -- I know, I'm wrong.

I've made a mistake.

I own it, and now I'm screwed.

And I just got 50% cut in my work.

I might lose my job in two months.

I've got all these bills."

Like, how do you even respond to something like that?

>> Well, I certainly don't say, "I told you so."

That's not the message, because I've been there.

I've done stupid stuff, too, and that's not helpful, and it doesn't bring any healing.

The thing is this -- We all get wake-up calls.

>> Mm-hmm.

>> We get wake-up calls in our relationships, our spiritual walk, our leadership styles.

We get wake-up calls in our finances.

And some people, the phone's ringing off the hook right now.

They're getting wake-up calls on a bunch of things.

They're at home with their family, and they're starting to realize, "I was disconnected from my family.

I haven't been plugged in."

They got a wake-up call on their relationships at home.

They've gotten a wake-up call on, you know, "I don't have any savings and I'm deeply in debt.

This isn't working."

And so, you know, the cool thing is when you get the call, then you have to make the choice.

Are you going to answer the phone?

If you pick the phone up, that means, baby, it's time to change.

And you can look back and you might be 27 years old right now watching this and you're screwed.

You lost your job.

You got no money, got no savings, and you feel like it's all over.

And I remember in 1970, I was 10 years old and I was in my grandpa's backyard.

We were tearing down an old deck, and I pulled some nails out of those old boards as we were taking the boards off.

And he taught me to put them down and straighten them with the hammer and save those used nails in a coffee can.

Now, my Grandpa Ramsey was one of my favorite people on the planet.

This is 1970 and he was still answering the phone that rang in the Great Depression.

It changed his life.

He was frugal and careful and wise with money the rest of his life.

And so someday, 27-year-old, you're going to be sitting on the back porch with your grandkid.

And you're going to remember "Back in aught 20, there was the coronavirus and it changed my life," you know, and you're going to be that guy.

You're going to be giving dad jokes, you know, and grandpa jokes.

Right, like I am now.

And you're going to get that opportunity.

I was 28 years old when I lost everything.

It was my fault.

It was the S&L crisis.

The banking climate changed.

I'd built a house of cards.

I was stupid.

And the phone rang.

That was my wake-up call.

Are you gonna answer the phone?

Are you gonna change your life to where you say "never again"?

"I'm going to control the controllables to where I'm the little pig in the brick house.

Never again."

That may be the only thing you get out of this crisis.

And if it is, you got enough.

>> Preach to me, Dave.

Come on now.

I love this.

>> [ Laughs ] >> What is the most common thing that you're hearing with your -- the people that are calling in for you right now?

What's the thing that you hear over and over again that they need the most support with?

>> I think when hope gets gut-punched the way it has for folks right now, the answers fall -- a lot of them fall in the category of "this is not going to last forever" because there's a sense that, you know, stock market's down.

"Do I take my investments out?"

Well, only if you think it's going to stay down forever.

>> Right.

>> Because, you know, you're 35.

You're gonna be investing for 30 more years.

You don't think it's gonna come up in 30 more years?

I mean, really, you're predicting the end of America?

I mean, that's silly.

But your emotions tell you lies when they're based in fear and when they're based in anger and they tell you lies and they tell me lies.

We believe those lies in situations like this.

So, you know, I lost my job.

I know.

But that's happened before and probably happen again.

Just get you another one.

[ Mumbling ] Yeah, there's a lot of people hiring right now.

>> There are a lot of people hiring.

>> Amazon's hiring 100,000 people right now.

>> Yeah.

>> So, I mean, there's jobs.

It might not be the one you want, but you can get some food.

>> Yeah.

>> I mean, get you a leaf blower and rich people are afraid of leaves, you know.

I mean, you can make some money.

So there's some stuff to do out there.

So the thing -- the sense that the thing you're afraid of is going to last longer than it is... >> Yeah.

>> ...whether it's the actual virus, whether it's the shutdowns, whether it's economic repercussions of the shutdowns, whether it's the employment situation, whether it's the quarantine, it feels like it's gonna last forever.

But I mean, the chances of you being in the exact situation you're in in a few months is almost zero.

Your life is not a snapshot.

You're not trapped in this moment.

It's a filmstrip.

The story's going to continue to unfold.

And so when hope takes a gut punch, though, and when we get down in that fear or we're mad or however it is we manifest that stuff, those negative things, the emotions that we all have in these situations, that's where a lot of my questions are coming.

They're all built in that.

I'm spending all my time going, "Uh, yeah, but it's not going to last forever."

You know, some people are going to have devastating, horrible things that are going to be life-changing.

But that's a very small percentage compared to the number that are worried about it.

>> Yeah.

>> And so, you know -- >> And you're gonna get out of it.

You're gonna get out of it.

>> You're gonna be okay.

You're gonna be okay.

>> I like Preacher Dave, man.

This should just be a preacher show.

You know, I like this.

What is the worst investment people should be making during this time and what's the best investment they can make?

>> In my life when I have become desperate, right after that is when I become stupid.

>> [ Laughs ] >> Well, you know, when you get scared and you go rushing towards something out of fear, that sense of desperation, this "aaaaaah," thing, when you do that, you're getting ready to screw up.

I mean, just count on it.

And the other time you do that is if you're greedy.

If you think, "Okay, I got this one.

I can take advantage of this," I mean, greedy as a lack of virtue greedy.

I don't mean greedy in a positive way where I'm being ambitious, okay?

I mean the negative sides of greed.

And so if you're functioning in desperation or in this no-holds-barred, "I'm going to just clean up on other people's pain" thing, that's when you're getting to screw up and you're getting ready to make a major mistake.

And so you're set up also for con artists when you do that.

And so if you're functioning in high emotion, your brain just doesn't work good.

My friend Art Laffer says when you're panicked and when you're drunk, you don't make good decisions.

And so, you know, when you're on high emotion, your brain is -- your critical thinking skills shut down.

And so that's when I made the biggest mistakes in my life, is when I was desperate and the few times that I was greedy where I thought, "Oh, I'm gonna slip in there and that's going to be easy money."

>> Could you share a story of one of those greedy times when you tried to jump in and it didn't work out?

>> A buddy of mine -- I was in my 20s, and a buddy of mine was buying gold.

Now, this is in the '80s, okay?

It's a million years ago.

And he's buying gold.

And he had this friend that was a gold -- he was a gold bug.

He was picking gold.

And this guy had picked the gold prices where they were going within a dollar like 14 times in a row.

And so we both dropped 5 grand into this thing, and if we had hit -- it was a margin deal, and so I would have made 50 grand and I thought, "I'm putting 5,000 bucks in here.

I'm gonna make 50 grand."

But it's a margin play, which means you're either gonna make 50 grand or you're gonna make zero.

And so he picked it right 14 times.

The time I got in, the 15th time, missed it.

I got zero.

Turned 5,000 bucks into zero instantly.

Last time I bought gold.

Last time I played stuff on margin.

Last time I got greedy.

>> So what's the difference between greed and a great opportunity of being ambitious?

Can you make money fast in certain things or is -- typically most things take a certain amount of time and energy and effort?

>> The vast majority of people who are successful financially and successful have done it incrementally.

There's very few people who you see a meteoric rise in their wealth or their success that keep it.

And I think because you build your character along the way to be able to hold on and be able to do it, I think.

That's my theory on it.

I mean, I got rich quick.

I started with nothing.

And by the time I was 26, I had $4 million worth of real estate.

I built a house of cards, you know, and I had a million-dollar net worth.

I made $250,000 in 1984.

I was making 20,000 bucks a month and in my 20s.

So, I mean -- but you'd have thought I had it all figured out.

Meteoric rise to the top.

But the very thing that caused me to -- the incredible overdrive of ambition caused me to go so fast that I missed the blind spots, I missed the detour signs, I missed the "bridge out" signs.

And so I built this house of cards I thought was a stone house.

But I was naive and didn't know.

And along comes some regulations changes, a few shifts in the economy, a little S&L crisis and kaboom.

>> It all comes down.

>> You know, all of a sudden Dave looks like an idiot instead of a genius.

And so it turns out I was a little of both because you don't build something like that at 25 if you're not somewhat of a genius.

But I was obviously an idiot in the way I built it.

And so I get to do it again if the wonderful opportunity to start over.

>> And build it the right way, yeah.

>> Yeah.

But I mean, in the midst of that as I was falling -- it took 2 1/2 years to lose everything we own.

I had stuff presented to me.

I almost got conned, serious con, like people just -- a real con artist type guy.

There's not many of them out there.

Most of the time you get screwed by well-meaning ignoramuses.

But these were real con artists coming into my path.

And I was about to give them money because I so desperately needed to turn quick money into big money to save myself.

I was desperate, and right about the time you get desperate is when you get stupid.

>> So don't make those decisions.

So what I'm hearing you say is the wealthy, wealthy people, it takes time and it's incremental.

It's not an overnight thing.

It's not a quick rise.

There might be some spikes here and there, but it's typically over time.

>> It's okay to take a spike.

But any time I get a spike, I'm always a little suspicious of it.

>> Really?

>> It makes me even more careful.

I draw back and I go, "Well, that's really cool.

Is it okay?"

You know, because it's not normative.

Normative is incremental.

And so I always tell entrepreneurs it's okay to be on the cover of Slow Company magazine.

>> [ Laughs ] I love this.

Now, something that you mentioned and something I just know about you as an individual, your values and the values of your business and your brand is how important character is from every person that comes there.

I think it's a 12-part interview series before someone can be hired.

Is that correct, 12?

>> Yeah.

>> 12 interviews.

And I'm not sure how public that is, so let me know if -- >> That's okay.

That's fine.

You go through the wringer to get in here.

>> Yeah, exactly.

Pretty much takes you six years to get a job with Dave Ramsey.

>> [ Laughs ] Not that bad.

>> They talk to your spouse and your dogs and everything to make sure that you have great character.

And this is what I love about you, is your leadership on a certain standard for the human beings you surround yourself with and who are part of your mission.

And I think it's really inspiring and I look up to that.

I'm curious.

How do you teach character for people that don't have what you want yet and maybe not everyone's at the level you want, but how do you -- can people change their character over time?

And how do you shift that?

>> Oh, yeah.

I mean, it's a decision.

You can just decide.

I mean, think about it.

What's integrity?

Integrity.

I can just decide I have it.

>> Yeah.

>> And now I do.

And I start acting out of the fact that I am a person of high integrity.

I'm a person who's dependable.

I'm a person you can count on.

I got your six.

I got your back.

But you can just decide... [ Claps hands ] ...just like that to change.

And so it's a wonderful decision.

In Christianity, we call it repentance.

You're walking one way.

You stop, you turn, you walk the other way.

That's all it is.

You turn around.

You do a turn-around.

And so for most of us, it's a journey.

You don't do it instantaneously.

I can decide to control my tongue.

I can decide to speak life over people rather than death and filth over them.

I can decide that.

I don't always do it right.

I just told you a minute ago.

Sometimes I'm a jerk, right?

But it's a -- And we don't -- By the way, we don't have any perfect people working here.

We have people that are trying.

We aspire to be people that can be counted on.

We aspire to be people of value.

We aspire to be people of noble character.

And when we don't, then we know that we didn't.

But most people just go along and their language is filthy and their life is filthy.

And then they wonder why they're not attractive and they wonder why they're not winsome and that opportunity does not come to them.

It's because opportunity runs from that.

People don't want to do deals with people they can't count on, who are crooks.

They don't want to do deals with people who, you know, run around on their wife.

Because if you run around on your wife, you're probably gonna mess me over in a business deal.

I mean, you know, so this is a lack of character.

And so I'm always leery when I run into that out there in the marketplace when we're doing deals, we're hiring a vendor, we're bringing somebody on the team, we're interacting with new friends we have and so forth.

And it's not that I'm being judgmental.

I just want to be wise because, you know, you become who you hang around with, for sure.

Your speech patterns, you read the same books, you have the same thought patterns.

You're hopeful or fearful based on who you run around, your inputs.

You know, we know this because those of us that raise kids, we don't let our kids run around with juvenile delinquents because we know they'll come home acting like juvenile delinquents.

Hello.

>> Right.

>> And adults aren't any different.

They're the same thing.

I read the same books my best buds read.

I think the same way they think.

And so I have to be careful who's my inner circle, who's my posse that's influencing Dave.

>> What's the greatest lesson that your father taught you?

>> My dad was in the real-estate business when I was growing up and was a student of all the great sales trainers and positive thinkers of that day.

So I mean, we had breakfast, lunch and dinner with Zig Ziglar, Earl Nightingale, Paul Harvey, Cavett Robert, Charlie "Tremendous" Jones.

And he infected us, my dad did, infected my sister and I with the belief that we can do anything.

I really believe I can do anything.

Now, not within -- I mean, I guess within -- I'm not gonna be in the NBA, okay?

I'm not gonna play in the NFL, okay?

I don't mean that.

But I'm saying if I apply myself and I figure out what the steps are and what the blockers are and I do the steps and I overcome the blockers, it's up to me.

The cavalry's not coming.

And so it was a wonderful, wonderful childhood in that regard.

Very entrepreneurial household that goes with that, obviously.

But if you will get up and leave the cave, kill something and drag it home, you'll be okay.

>> I'm curious for you as well.

The thing you admire and respect the most about why you decided to be with your wife.

>> She has uncanny, scary wisdom.

>> Do you lean on her for a lot of feedback or wisdom on big deals that you do or decisions in the business?

>> Yeah.

One of the things we learned when we went broke was that I was not listening to her.

But when we get ready to make major decisions, a major purchase of an asset at the office, a major hire of a leader, I'm just looking for her discernment, you know, because she's got those antennae on her head.

She can go, "Weirdo, weirdo," you know, and she can spot them a mile away, and I can't.

>> This is called the Three Truths.

I ask this to everyone at the end.

I want you to imagine a hypothetical situation.

It's the last day on Earth for you and it's 100 years from now or however long that you can live and you have achieved everything.

You have built this amazing business.

You've seen your family grow up and people are happy.

You've done it all.

And for whatever reason, you've got to take all of your audio, videos, books.

You've got to take them with you to the next place so no one has access to your content anymore.

Again, hypothetical.

And all you can leave behind were the three things you know to be true.

That would be the three lessons you would leave behind with everything you've learned in your life.

What would be your Three Truths?

>> God is real.

You can count on Him.

People are worth the investment.

They'll be your greatest joy and they'll break your heart, but they're worth the investment.

And everybody needs a dog.

[ Both laugh ] >> I've never heard that one, but I just got a dog six months ago, and it's like the greatest joy of my life right now.

I love that answer.

The final question -- what's your definition of greatness?

>> I have to probably wordsmith a little bit, but it's gonna have something to do with service.

There are very few people that are great that don't know how to serve.

There are very few people that are happy that haven't learned how to serve, whether the service becomes generosity or whether it's a servant leader or whether it's a dad who gives really good hugs to his babies, it's got to be around service.

>> Dave Ramsey, thank you for your love and generosity and your wisdom.

I really appreciate you.

Thank you very much.

We hope you enjoyed this episode and found it valuable for your life.

Make sure to stay tuned for more from "The School of Greatness" coming soon on public television.

Again, I'm Lewis Howes, and if no one has told you lately, I want to remind you that you are loved, you are worthy, and you matter.

And now it's time to go out there and do something great.

If you'd like to continue on the journey of greatness with me, please check out my website, lewishowes.com, where you'll find over 1,000 episodes of "The School of Greatness" show, as well as tools and resources to support you in living your best life.

>> The online course "Find Your Greatness" is available for $19.

Drawn from the lessons Lewis Howes shares in "The School of Greatness," this interactive course will guide you through a step-by-step process to discover your strengths, connect to your passion and purpose, and help create your own blueprint for greatness.

To order, go to lewishowes.com/tv.

♪ ♪ ♪

Support for PBS provided by:

The School of Greatness with Lewis Howes is presented by your local public television station.

Distributed nationally by American Public Television